Investment Management Business

For investors around the world seeking asset management in real estate, Mitsubishi Estate group globally offers a wide range of products, such as REITs (real estate investment trusts) for long-term and stable management needs and private funds in response to specific management needs of institutional investors. It is provided through the collaboration of four platforms in Japan, the United States, Europe, and Singapore, based on our professional expertise accumulated through the operational records.

Meeting various investor demands by building a global platform

Overseas, we have strategically built a global platform through M&A. We acquire and operate assets based on our local knowledge, networks, and achievements in each market. In Japan, we offer a diverse product lineup, including listed REITs, privately placed REITs, and privately placed funds, which have the largest amount of assets under management in Japan, and respond to domestic and foreign investor demand through stable asset management. We have built a global platform (Mitsubishi Estate Global Partners) that links our bases in Japan, the United States, Europe, and Asia, and provide global services to meet investor demand for cross-border and diversified investment effects.

Our investment management business platform is named Mitsubishi Estate Global Partners, and "MEGP" has been launched as our global brand since March 2023.

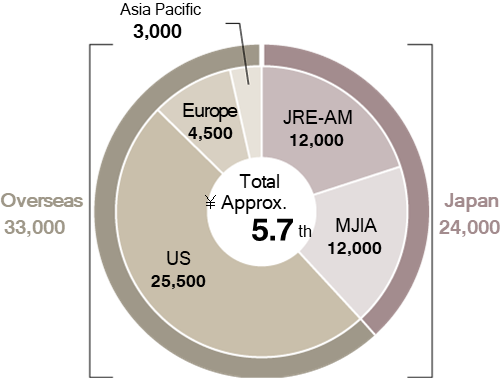

Expanding our global AuM (assets under management)

to JPY5 trillion as of 2022

Assets under Management

(Billions of yen)

*Domestic as of the end of March 2024, overseas as of the end of December 2023

Pioneer of J-REITs

Japan Real Estate Asset Management (JRE-AM)

Established in 2000, it is an asset management company for Japan Real Estate Investment Corporation, the first J-REIT listed on Tokyo Stock Exchange in September 2001. Through investments mainly in core-type office buildings, the company has earned a good reputation from the market for its stable performance and proactive information disclosure.

Providing high-quality investment and management opportunities with track records and comprehensive capabilities

Mitsubishi Jisho Investment Advisors (MJIA)

Established in 2001. The company provides a wide range of real estate investment products for institutional investors in Japan and overseas; a private REIT, Nippon Open-Ended Real Estate Investment Corporation, a listed logistics REIT, Mitsubishi Estate Logistics REIT Investment Corporation and private funds for various needs.

US Leading Real Estate Investment Management Company

TA Realty

Founded in 1982, the company is one of the US leading real estate investment management firms and has provided diverse products; commingled value-added funds, a core open-ended fund "TA Realty Core Property Fund" launched in 2018, and various real estate funds investing in logistics, multifamily properties, offices, and retail strip malls in major cities across the United States. It has been a consolidated subsidiary by M&A in 2015.

Expanding business across Europe

Europa Capital

Founded in 1999. Based in the United Kingdom, the company has expanded its business throughout Europe, managing commingled value-added funds, a core-type open-ended fund "the Europa Diversified Income Fund", as well as diverse funds investing in offices, multifamily properties, retails, and logistics. It has become a consolidated subsidiary since 2010.

Expanding our business in Asia Pacific region

MEC Global Partners Asia

Established in 2017. The Singapore basis company has managed a core-type open-ended fund and value-added funds investing in real estate located in Asia Pacific region.

Strategic Perspective of the Mitsubishi Estate Group

New Targets of JPY10 trillion of AuM and JPY30 billion of Operating Income for FY2030

Under the "Long-Term Management Plan 2030," beginning from FY2020, Mitsubishi Estate group has positioned the non-asset business as one of the growth areas, and will aim to further expand the investment management business as its core role.

Having achieved the AuM (Assets under Management) target of JPY 5 trillion by mid 2020s in the original plan, we have now set new targets of AuM of JPY10 trillion and operating income of JPY30 billion for FY2030.

By accomplishing these new targets, we aim to establish ourselves as one of the top global players in the real estate investment management industry.