報酬

報酬

.png)

役員報酬等の額の決定に関する方針Board Policies and Procedures in Determining the Remuneration of Senior Management and Directors

(ⅰ)役員報酬の決定手続き

当社の取締役及び執行役の報酬の内容に係る決定に関する方針及び個人別の報酬の内容については、社外取締役のみの委員にて構成される報酬委員会の決議により決定する。

(ⅱ)役員報酬決定の基本方針

当社の取締役及び執行役の報酬決定の基本方針は次の通りとする。

(ⅰ) Procedures for Deciding Remuneration Paid to Officers

The policy concerning decisions on the details of remuneration paid to directors and corporate executive officers of the Company and the details of remuneration for each person shall be decided upon by a resolution of the Remuneration Committee, which comprises

solely outside directors.

(ⅱ) The Basic Policy for Deciding Remuneration for Officers

The basic policy for deciding remuneration for directors and corporate executive officers of the Company is as follows.

- 経営戦略や中期経営計画における中長期的な業績目標等と連動し、持続的な企業価値の向上と株主との価値共有を実現する報酬制度とする。

- 戦略目標や株主をはじめとするステークホルダーの期待に沿った、経営陣のチャレンジや適切なリスクテイクを促すインセンティブ性を備える報酬 制度とする。

- 報酬委員会での客観的な審議・判断を通じて、株主をはじめとするステークホルダーに対して高い説明責任を果たすことのできる報酬制度とする。

- The remuneration system shall be linked with our medium- to long-term performance targets, etc., aimed at in management strategies and medium-term management plans and realize sustained corporate value improvement and the sharing of value with our shareholders.

- The remuneration system shall allow for the giving of incentives to management executives to encourage them to take on challenges and conduct appropriate risk-taking in line with the above strategies' targets and expectations of shareholders and other stakeholders.

- The remuneration system shall make it possible to fulfill high accountability for the benefit of our shareholders and other stakeholders through objective deliberations and judgments by the Remuneration Committee.

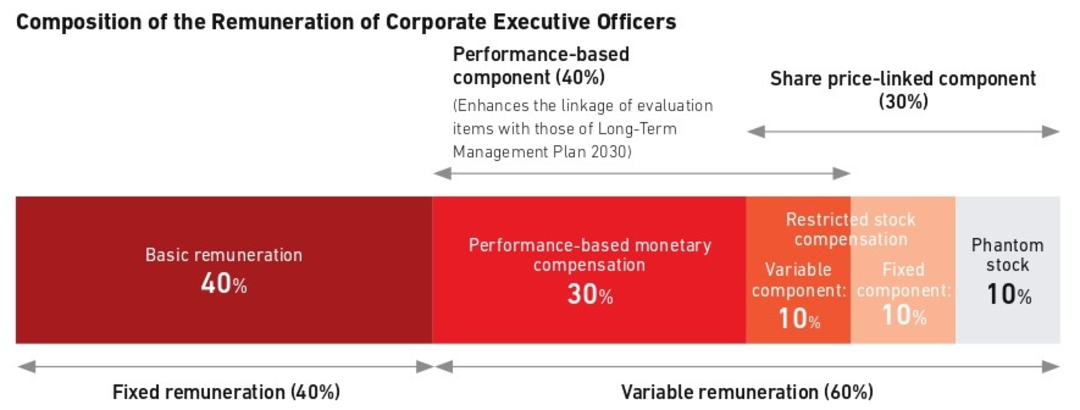

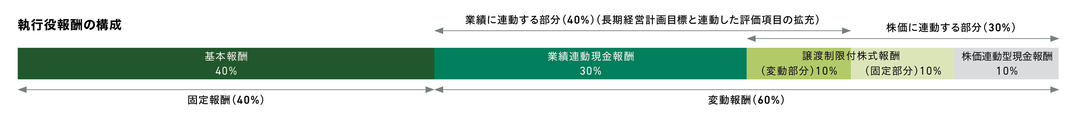

(ⅲ)役員報酬体系

取締役と執行役の報酬体系は、持続的な企業価値向上のために果たすべきそれぞれの機能・役割に鑑み、別体系とする。なお、執行役を兼務する取締役については、執行役としての報酬を支給することとする。

(ⅲ) Remuneration Systems for Officers

Remuneration systems for directors and corporate executive officers shall be separately established in consideration of their respective functions and roles to be fulfilled for the purpose of achieving sustained corporate value improvement. In addition, directors who concurrently serve as corporate executive officers shall be paid remuneration as corporate executive officers.

-

取締役(執行役を兼務する取締役を除く)

執行役及び取締役の職務執行の監督を担うという機能・役割に鑑み、原則として金銭による基本報酬のみとし、その水準については、取締役としての役位及び担当、常勤・非常勤の別等を個別に勘案し決定する。 -

執行役

当社の業務執行を担うという機能・役割に鑑み、原則として基本報酬及び変動報酬で構成する。変動報酬は、短期的な業績等に基づき支給する金銭報酬と、中長期的な株主との価値共有の実現を志向し支給する株式報酬等(株価等の指標に基づき支給する金銭報酬を含む)とで構成する。基本報酬・変動報酬の水準及び比率、変動報酬の評価指標等については、経営戦略や経営計画における中長期的な業績目標等、並びに執行役としての役位及び担当等を勘案し決定する。 -

Directors (excluding directors who concurrently serve as corporate executive officers)

In consideration of their function and role of supervising the performance of duties by corporate executive officers and directors, they shall receive, in principle, only basic remuneration in the form of cash, and the standards shall be decided upon individually taking into account factors such as their position and responsibilities as directors and whether they are full-time or part-time. -

Corporate executive officers

In consideration of their function and role of taking charge of business execution of the Company, their remuneration shall, in principle, comprise basic remuneration and variable remuneration. Variable remuneration comprises monetary compensation that is paid based on short-term performance, etc., and stock compensation, etc. (including monetary compensation paid based on indicators such as stock price), that is paid with a view to realizing the medium- to long-term sharing of value with shareholders. The standards and ratios of basic remuneration and variable remuneration, valuation indicators for variable remuneration, and other matters shall be decided upon taking into account medium- to long-term performance targets, etc., aimed at in management strategies and the current management plan and factors such as position and responsibilities as corporate executive officers.

業績連動報酬の概要Overview of Performance-Based Remuneration

(1)業績連動現金報酬(1)Performance-Based Monetary Compensation

① 報酬形態:金銭

② 業績評価及び報酬の決定方法

① Form of remuneration: Cash

② Performance evaluation and method for

determining remuneration

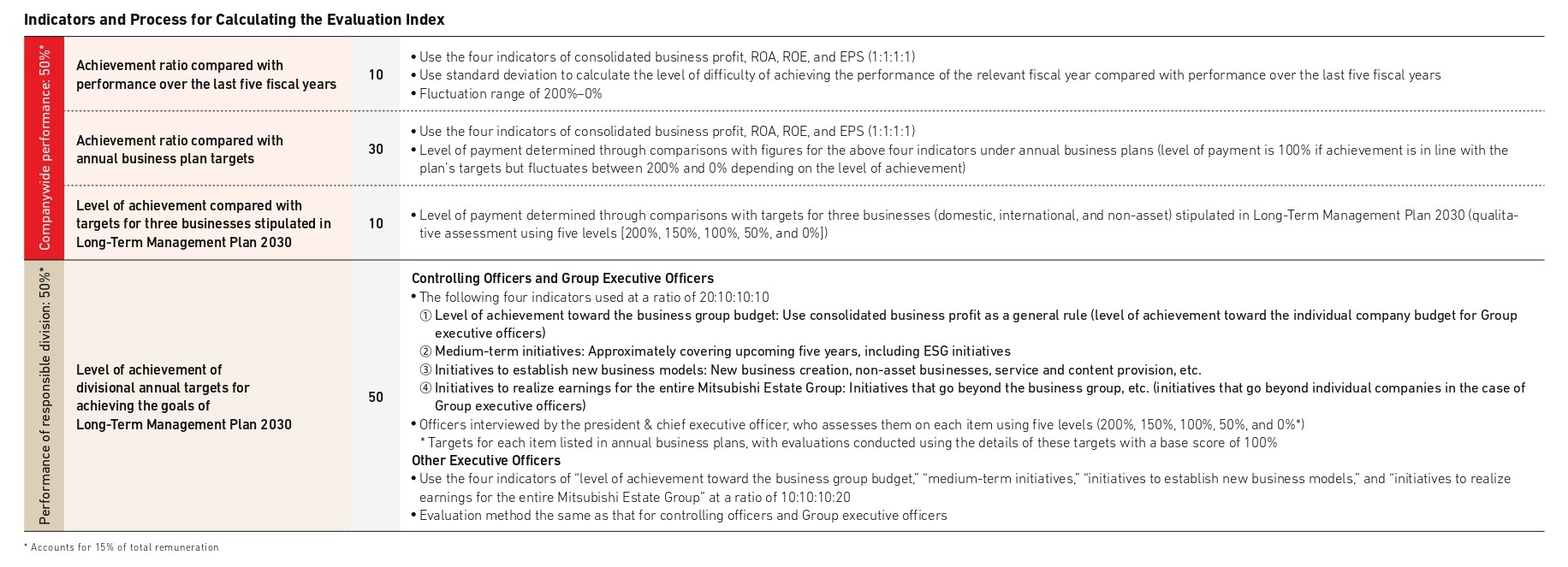

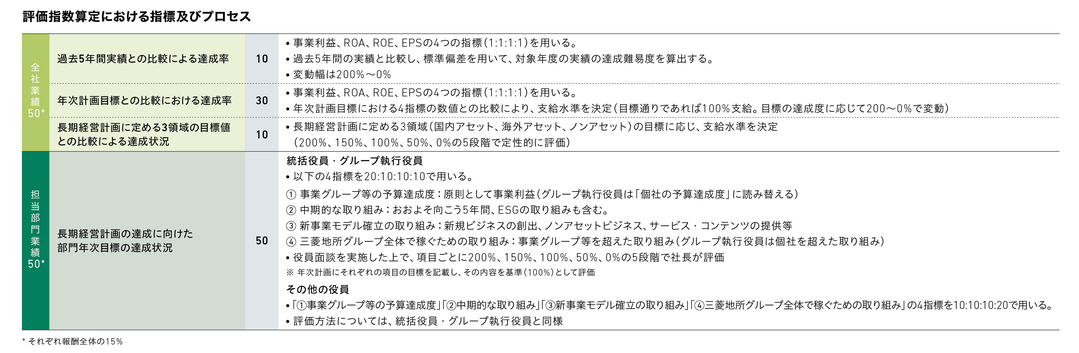

- 財務の健全性を担保しながら企業としての成長及び効率性向上を目指すことを目的に、全社の事業利益、ROA、ROE、EPS及び各役員が担当する部門の事業利益等の目標水準を基準とし、報酬金額が変動します。

- 報酬の決定にあたっては、各指標の前年度実績等に加え、社長面談による中長期的な業績への貢献度合い、ESGに関する取り組み状況、長期経営計画に定める各事業(国内アセット、海外アセット、ノンアセット)の進捗状況等の定性面における評価を用いて報酬金額を算出し、最終的な報酬金額を報酬委員会にて決定しています。詳細は下表をご参照ください。

- With the aim of achieving further corporate growth and greater efficiency while guaranteeing financial soundness, the amount of remuneration varies depending on consolidated business profit, ROA, ROE, EPS, and the target level of business profit in the divisions for which the individual officers are responsible.

- When determining remuneration, the amount is calculated using the actual indicators, etc., for the previous fiscal year, to which is added an evaluation of qualitative aspects, established during interviews with the president,* including the degree of contribution to performance over the medium to long term and the status of ESG-related initiatives, the level of progress of each business (domestic, international, and non-asset) in achieving targets stipulated in Long-Term Management Plan 2030, with the final remuneration amount being decided by the Remuneration Committee. Please see the table on page 85 for details.

(2)譲渡制限付株式報酬(固定部分、変動部分)(2)Remuneration by Shares with Restriction on Transfer (Fixed and Variable Components)

① 報酬形態:株式

② 譲渡制限期間:役員退任時まで

③

業績評価及び報酬の決定方法:

① Form of remuneration: Shares

② Restricted stock period: Until an officer

resigns

③ Performance evaluation and method for determining remuneration

- 企業価値の持続的な向上を図るインセンティブを与えるとともに、株主との一層の価値共有を推進することを目的に、役員退任時までの譲渡制限期間を付した株式報酬を採用しています。株式を割り当てる際の金銭報酬債権額は、報酬委員会にて決定します。

- 変動部分における報酬の決定方法及び主な評価項目は「(1)業績連動現金報酬」と同様の評価指標を用いて決定します。

- With the objectives of creating incentives for officers to achieve sustainable growth and of further aligning officers' interests with those of shareholders, the Company adopted stock-based remuneration with a restricted transfer period that runs until the time an officer resigns. The amount of monetary compensation that can be claimed when allocating stock is determined by the Remuneration Committee.

- The Company will determine the method for deciding variable remuneration and the major evaluation items by using the same evaluation items as those for (1) Performance-based monetary compensation.

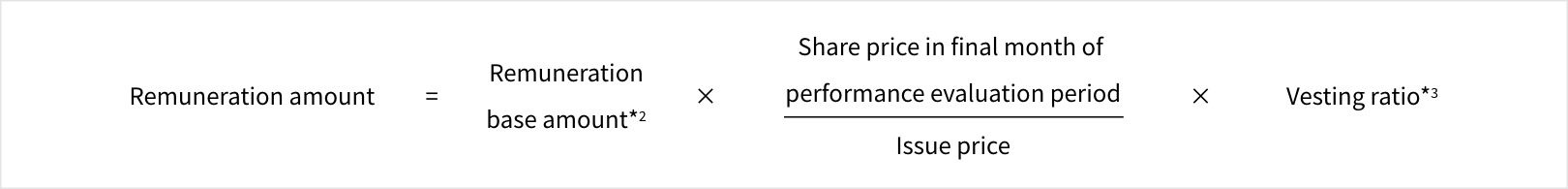

(3)中長期業績連動報酬(株価連動型現金報酬)(3)Medium- to Long-Term Performance-Based Remuneration (Phantom Stock)

① 報酬形態:金銭

② 業績評価期間:約3年間

③

業績評価及び報酬の決定方法

企業価値の持続的な向上を図るインセンティブを与えるとともに、株主との一層の価値共有を推進することを目的に、株価及び同業他社※1と比較した株主総利回り(TSR)の順位を指標として、報酬金額が変動します。役位ごとの報酬基準額及び最終的な報酬金額については、報酬委員会にて決定します。

① Form of remuneration: Cash

② Performance evaluation period: Approximately

three years

③ Performance evaluation and method for determining remuneration

With

the objectives of creating an incentive to work for sustainable growth and of

promoting the further sharing of value with shareholders, the amount of phantom

stock remuneration varies depending on the share price and on an indicator based on

the Company's total shareholder return (TSR) ranking relative to five peer

companies.*1 The base amount by position and the final remuneration amount are

determined by the Remuneration Committee.

※1 同業他社

野村不動産ホールディングス株式会社、東急不動産ホールディングス株式会社、三井不動産株式会社、東京建物株式会社、住友不動産株式会社

※1 Five peer companies:

Nomura Real Estate Holdings, Inc., Tokyu Fudosan

Holdings Corporation, Mitsui Fudosan Co., Ltd., Tokyo Tatemono Co., Ltd., and

Sumitomo Realty & Development Co., Ltd.

④ 個別支給金額の算定方法④ Calculation method for individual amount paid

※2 報酬基準額

報酬基準額は、支給対象者の職位に応じて、それぞれ以下のとおりとする。

※2 Remuneration base amount

The remuneration base amount corresponds to the

rank of the officer eligible for payment, as listed below.

| 執行役社長 | 執行役副社長 | 執行役専務 | 執行役常務 | 執行役 |

|---|---|---|---|---|

| President and chief executive officer | Deputy president | Executive vice president | Senior executive officer | Corporate executive officer |

| 21,300 千円 |

12,675 千円 |

10,413 千円 |

8,352 千円 |

6,288 千円 |

| ¥ 21,300,000 |

¥ 12,675,000 |

¥ 10,413,000 |

¥ 8,352,000 |

¥ 6,288,000 |

※3 権利確定割合

当社及び同業他社の各TSRを順位付けし、100%を上限として、当社のTSR順位に対応する下表の割合とする。

※3 Vesting ratio

A rank is given to the TSR of the Company and its peers. The

percentages in the table below correspond to the Company’s TSR rank, with 100% being

the upper limit.

| TSR順位 | 1位 | 2位 | 3位 | 4位 | 5位 | 6位 | |

|---|---|---|---|---|---|---|---|

| TSR rank | 1st | 2nd | 3rd | 4th | 5th | 6th | |

| 権利確定割合 | Vesting ratio | 100% | 80% | 60% | 40% | 20% | 0% |

なお、TSRは以下の算式により算出する。

TSR is calculated using the formula below.